Personal finance is the process of managing how you earn, spend, save, invest, and protect your money. Most of us spend the first 20 years of our lives learning how to earn money, but we rarely spend even 20 hours learning how to manage it. We work hard for our salary, but by the 20th of each month, many of us find ourselves wondering where all the money went. Whether you are a college student receiving an allowance, a professional earning ₹50,000, or a small business owner, how you handle your money can affect your future peace of mind. Managing your money means overseeing its journey from the moment it enters your bank account to when you choose to spend or save it. This process is called personal finance. In this article, we’ll explain personal finance in simple terms using real-life examples from India.

What Is Personal Finance?

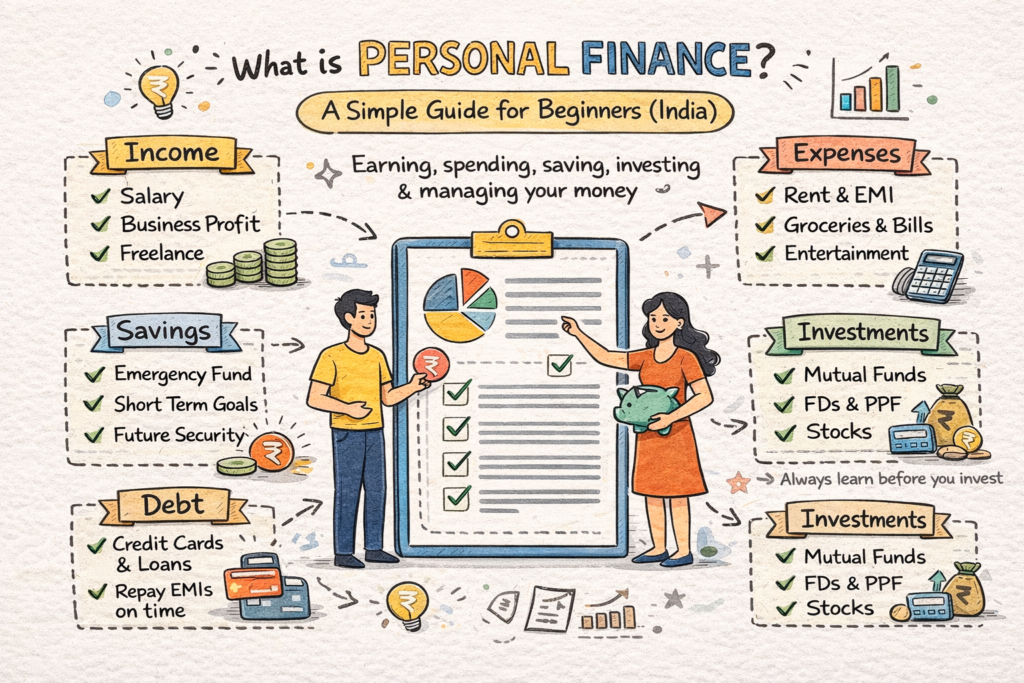

In simple language, personal finance is about planning how you earn, spend, save, and invest your money to live comfortably and reach your goals. It isn’t just about being wealthy. It is about being financially stable. It involves looking at five key areas:

- Income (What comes in)

- Expenses (What goes out)

- Savings (What stays with you)

- Investments (What grows over time)

- Debt (What you owe to others)

Whether you are a software engineer in Bengaluru or a shopkeeper in Jaipur, the principles of personal finance are the same.

Personal finance principles are followed by individuals, financial planners, and institutions worldwide to help people make informed money decisions.

Why Is Personal Finance Important?

Many people think they don’t need to learn about money until they have a lot of it. This is a mistake. Learning personal finance is important because it:

- Avoids Debt Traps: It helps you stay away from high-interest credit card debt or unnecessary loans.

- Handles Emergencies: Life can be unpredictable. Good financial planning ensures that a medical emergency or job loss doesn’t ruin you.

- Builds Wealth: Small amounts saved today can grow into large sums over 10 to 20 years thanks to compounding.

- Reduces Stress: When you know where your money is going, you can sleep better at night.

Main Components of Personal Finance

1. Income

This is your starting point. It includes your monthly salary, business profits, freelance income, or interest from a bank account.

2. Expenses

Expenses are divided into two types: – Needs: Rent, groceries, electricity bills, and insurance. – Wants: Dining out, buying the latest iPhone, or going on a weekend trip to Goa. The goal is to make sure that “Wants” do not consume the money allocated for “Needs.”

3. Savings

This is the money left after expenses. The first goal of personal finance is usually to build an emergency fund—cash set aside for 3 to 6 months of expenses.

4. Investments

Savings just sit there; investments grow. This includes mutual funds, Public Provident Fund (PPF), or fixed deposits (FDs). Note: Investing in stocks carries risks, so always learn or consult a professional before starting.

5. Debt Management

Debt isn’t always bad (like a home loan), but “bad debt” (like a credit card debt with 40% interest) can harm your finances. Managing debt means paying EMIs on time and keeping borrowings low.

Personal Finance Example (Indian Context)

Let’s look at Rahul, who earns ₹40,000 a month in Delhi.

- Bad Finance: Rahul spends ₹35,000 on rent, parties, and EMIs for a new bike. He has only ₹5,000 left, which he spends on random things. He has no savings.

- Good Finance: Rahul follows a plan. He spends ₹25,000 on essentials, saves ₹5,000 in a “rainy day” fund, and invests ₹10,000 into a mutual fund SIP.

Even with the same salary, the second Rahul will be much wealthier in five years.

Common Personal Finance Mistakes

- No Budget: Not knowing where the money is going.

- No Emergency Fund: Relying on a credit card every time the car breaks down.

- Overusing Credit Cards: Buying things you can’t afford just because of “No Cost EMI” offers.

- Social Media Tips: Following “finfluencers” blindly without realizing that everyone’s financial journey is different.

How to Start Managing Your Personal Finance

- Track Everything: For one month, write down every rupee you spend (even that ₹10 tea).

- Create a Simple Budget: Stick to the 50/30/20 rule (50% needs, 30% wants, 20% savings).

- Start Small: You don’t need ₹1 Lakh to begin. You can start a SIP with just ₹500.

- Educate Yourself: Read one financial article or book each week.

Is Personal Finance Different for Everyone?

Yes. A 22-year-old bachelor can take more risks than a 45-year-old with children and elderly parents. Your personal finance plan depends on your age, responsibilities, and future goals, such as buying a house or retiring early. According to the Reserve Bank of India, understanding money management is essential for long-term financial stability.

Conclusion

Personal finance is not just a math problem; it is a life skill. You don’t need to be an expert in accounting to manage your money well. You just need discipline and a clear plan. By taking control of your finances today, you are buying freedom for your future self.

In the next articles, we’ll break down saving money, budgeting, investing, and taxes in simple terms.